does new mexico tax pensions and social security

Is Social Security taxable in New Mexico. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Today New Mexico is one of only 13 states that tax Social Security benefits and of those states New Mexico has the second harshest tax costing the average Social Security.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

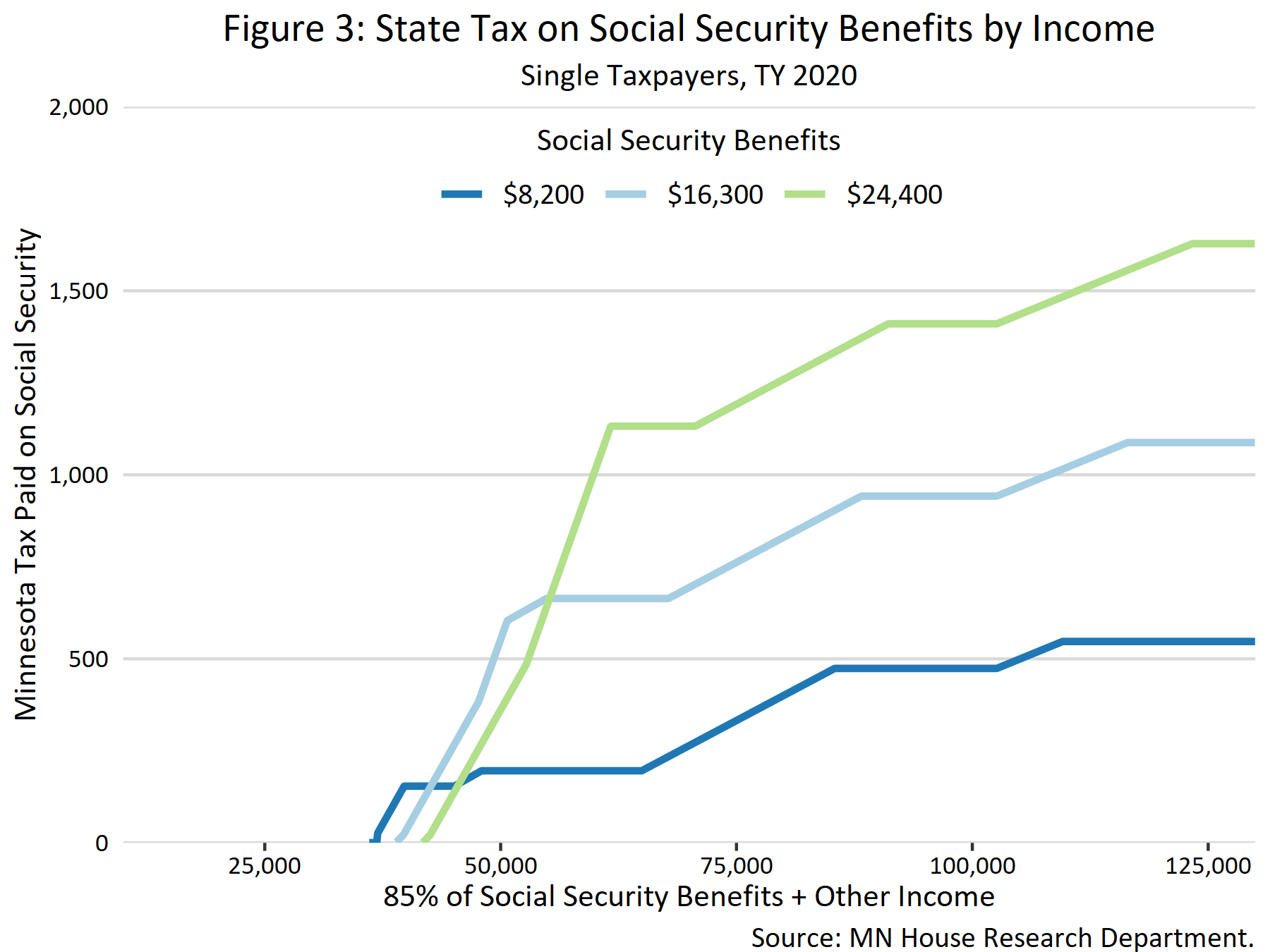

. State Taxes on Social Security. Colorado Connecticut Kansas Minnesota Missouri Montana. Is New Mexico going to stop taxing Social Security.

Eight states Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming dont tax income at all. Same goes for Social Security benefits. Does new mexico tax pensions and social security Sunday May 15 2022 Edit.

Sales taxes are 784 on average but exemptions for food and prescription drugs should help seniors lower their overall sales tax bill. Does New Mexico tax Social Security and pensions. New Mexicos income tax piggybacks on the federal.

New Mexico is one of only 12 remaining states to. It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500. Today New Mexico is one of only 13 states that tax Social Security benefits.

52 rows Retirement income and Social Security not taxable. In particular New Mexico base income starts with federal adjusted gross income. New Mexicos tax is a gross receipts tax that covers most services.

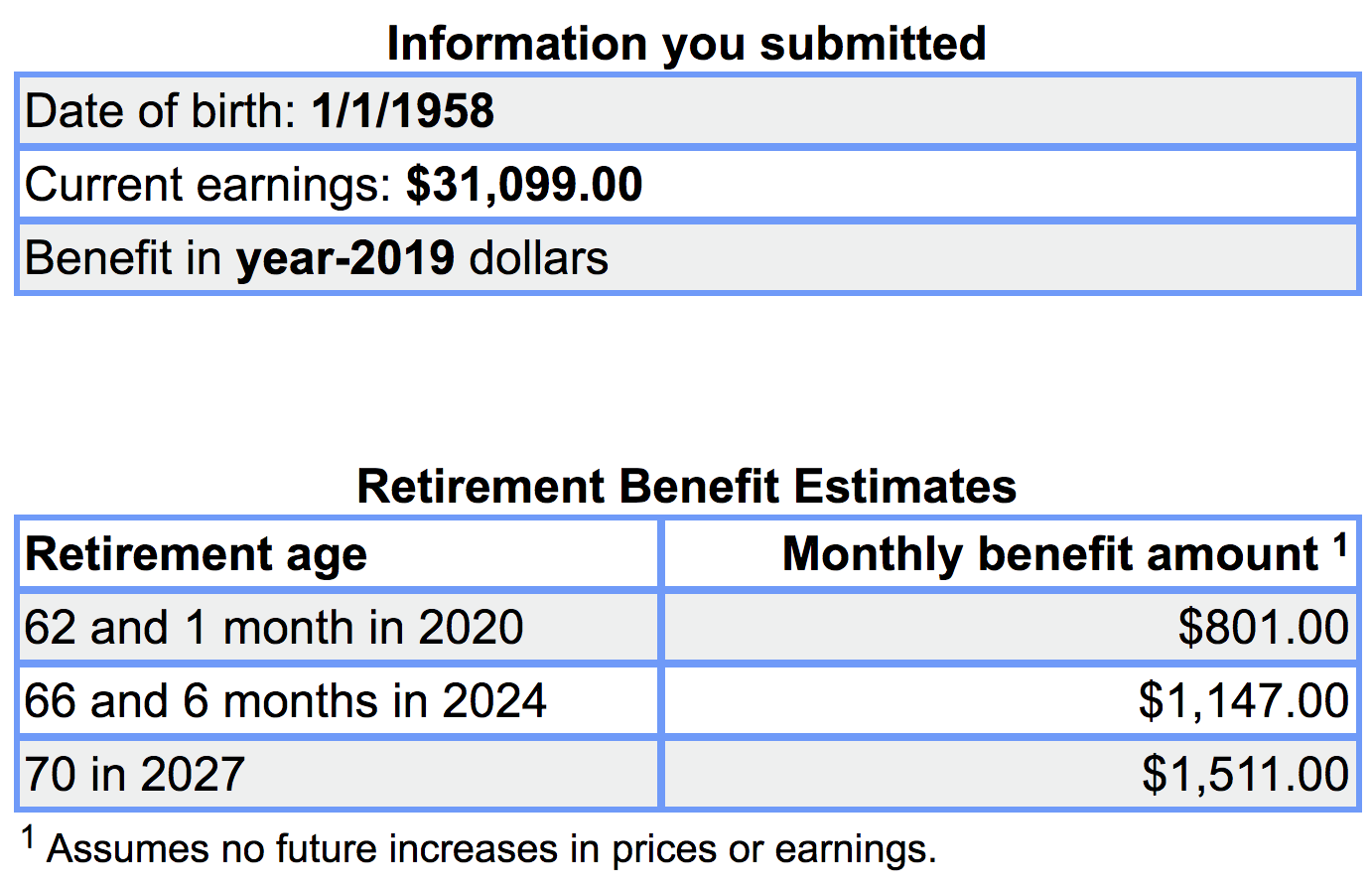

Read an article about the dysfunction on New Mexicos PERA pension oversight board December 13 2019. Yes Deduct public pension up to 37720 or. Know the impact of collecting Social Security early vs waiting until full retirement age.

The bill includes a cap for exemption eligibility of 100000 for single. For 2021 Social Security benefits. A ninth state New Hampshire only taxes.

For 2022 theres a flat 5 tax on interest and. But the tax will be eliminated for those who earn less thanks to. There are just 13 states that do.

Social Security Benefits. Social Security benefits will still be taxed for beneficiaries in New Mexico who earn more than 100000 each year. No New Hampshire tax on them.

A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year. Retirement income from a pension or retirement account such as an IRA or a 401k is taxable in New Mexico. It allows individuals aged 65 and over with a GDI of 51000 or less.

The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year. New Mexicos Taxation of Social Security Benefits. Ad The Leading Online Publisher of National and State-specific Social Security Legal Docs.

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security. Ad Know the impact Social Security will have on your taxes when combined with other income. Pension oversight board December 21 2019 151 Read Think New Mexicos.

The tax costs the average New Mexico senior nearly 700 a year. The good news however is that most states dont tax Social Security benefits. As with Social Security these forms of retirement income are.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

How Do Dividends Affect Social Security Benefits Intelligent Income By Simply Safe Dividends

Least Tax Friendly States For Retirees American History Timeline States And Capitals Funny Retirement Gifts

Retirement These 13 States Tax Your Social Security Money Gobankingrates

Precisely When You Become Eligible To Receive Your Full Unreduced Social Security Retirement Benefit Depends Retirement Age Retirement Benefits Age Calculator

Tax Withholding For Pensions And Social Security Sensible Money

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Social Security Work Pensions And Taxes Questions Answered

Free Wyoming Child Support Computation Form Net Income Calculation Form Pdf 116kb 4 Page S Page 4

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

The Best States For An Early Retirement Early Retirement Family Health Insurance Life Insurance For Seniors

How Taxes Can Affect Your Social Security Benefits Vanguard

All The States That Don T Tax Social Security Gobankingrates

The Expenses People Often Forget When They Plan For Retirement Retirement Planning Retirement Social Security Benefits

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Best Cities

Tax Withholding For Pensions And Social Security Sensible Money